Construction products manufacturers report positive Q1 after state of trade survey.

Construction product manufacturers reported a positive start to 2022, recording a seventh straight quarter of growth in sales in Q1, according to the Construction Products Association’s State of Trade Survey. Broad cost pressures remained across the sector but are yet to dent manufacturers’ expectations for growth in the year ahead.

In Q1, 43% of heavy side manufacturers and 50% of light side manufacturers reported that sales increased compared to 2021 Q4. Alongside this, all firms surveyed on both the heavy side and the light side reported an annual rise in costs. For the heavy side, this was the third consecutive quarter of universal cost increases.

Energy, fuel, raw materials, and wages and salaries were all reported higher in Q1, reflecting the rise in global commodity prices in 2021 and further volatility following Russia’s invasion of Ukraine in February, as well as domestic supply issues for materials and labour. Manufacturers anticipate inflationary pressures will remain near-term, but nevertheless, further sales growth is expected during 2022, according to 80% of heavy side firms and 77% on the light side.

Rebecca Larkin, CPA Senior Economist said: “Construction product manufacturers are now facing a sustained and intense period of rising input costs, with the Russia-Ukraine conflict compounding the rise in energy costs experienced at the end of last year. Whilst this is particularly pertinent for energy-intensive heavy side manufacturers of materials such as bricks, cement and steel, energy costs were reported higher for all light side manufacturers too.”

She also adds: “This comes on top of rising costs for fuel, materials, and labour, not just for manufacturers, but across the construction supply chain. Near-term demand is viewed as strong and although broader inflationary pressures across the economy threaten to erode business and consumer confidence and, ultimately, demand in key construction sectors, manufacturers’ expectations for growth this year remain buoyant given the high levels of activity currently on the ground.”

Key survey findings include:

- A balance of 43% of heavy side firms and 50% of light side firms reported that construction products sales rose in Q1 compared with the previous quarter, the seventh consecutive quarter of growth

- On balance, 80% of heavy side manufacturers and 77% of those on the light side anticipated a rise in sales over the next 12 months

- All heavy side manufacturers reported an annual increase in costs in Q1, the third quarter there has been a 100% balance

- Costs for fuel, energy and raw materials rose for all heavy side manufacturers

- All light side manufacturers also reported an annual rise cost, the first 100% balance in five years

- All manufacturers on the heavy side and 91% on the light side expect a rise in costs over the next 12 months

Overall, despite the increased pressure of higher costs and inflation, the construction products manufacturing industry has seen a strong start to Q1. Growth in sales is expected to continue during 2022, albeit alongside further upward pressure on input prices.

Here is a more detailed look at the State of Trade Survey.

For further reading, here is an interesting article relating to escalation in material prices, that may be of interest.

--CIAT

[edit] Related articles on Designing Buildings

- Code for Construction Product Information CCPI.

- Considerate Constructors Scheme.

- Construction Industry Council.

- Construction industry institutes and associations.

- Construction Products Association (CPA)

- Construction Products Association State of Trade Q1 2022

- Contractor vs supplier.

- LEXiCON.

- Persistent identifier.

- Post-Grenfell product code combats misleading marketing.

- Product manufacturers must regain confidence.

- Strategic Forum for Construction.

- Supplier.

- Supply chain.

- The Building Centre.

Featured articles and news

Homes England supports Greencore Homes

42 new build affordable sustainable homes in Oxfordshire.

Zero carbon social housing: unlocking brownfield potential

Seven ZEDpod strategies for brownfield housing success.

CIOB report; a blueprint for SDGs and the built environment

Pairing the Sustainable Development Goals with projects.

Types, tests, standards and fires relating to external cladding

Brief descriptions with an extensive list of fires for review.

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

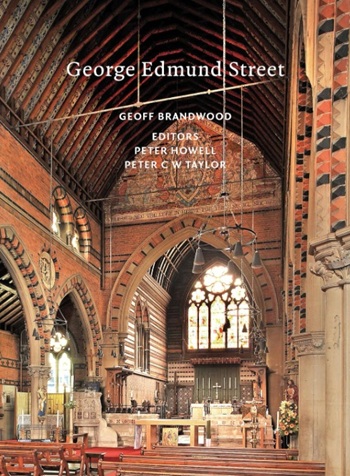

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.